Buying UK Property As An Overseas Investor

Can foreigners buy property in the UK? Discover how to access the market today

How can you buy UK property as an overseas investor? UK property terms and process explained

If you are an overseas buyer, you may be considering buying UK residential property as an investment whilst the value of the pound sterling is down. Before you decide to invest, read our guide on things non-resident buyers need to know about investing in UK property.

- Can I buy property in the UK as a foreigner?

- Freehold vs Leasehold

- What is a freehold property?

- What is a leasehold property?

- Tax on income made through rental property

- Tax Implications for Overseas Investors

- Bank lending and mortgage availability

- Choosing an area with sustainable demand

- Purchase process for property investments outlined

Can I buy property in the UK as a foreigner?

If you are wondering if you can buy property in the UK as a foreigner, the answer is - yes you can! You may have to adhere to different terms with regards to taxation and you will need to familiarise yourself with UK property terms. Read our guide below to find out how you can buy property in the UK.

Freehold vs Leasehold

Firstly, you can own property in two different ways. You may purchase a property and own the freehold, or you may own it as a leasehold. Below explains the difference between a freehold and a leasehold property.

What is a freehold property?

In England and Wales, a freehold means outright ownership of the land and the dwelling that sits on it. Most houses in England and Wales are owned on a freehold basis.

What is a leasehold property?

A leasehold means you only own the property for a fixed time. The duration is typically specified in a legal agreement with the landlord (the freeholder). Most flats are owned on a leasehold basis, as are houses that are bought through shared ownership schemes.

Tax on income made through rental property

One thing that may affect the profitability of a property investment is the income tax you may need to pay on it, and any additional costs such as stamp duty or even day-to-day maintenance. Until March 2021 there will be a stamp duty holiday. Although from April 2021 overseas investors will have to pay an additional 2% stamp duty.

Individuals have a tax-free personal allowance of up to £11,500 in the tax year from 6th April 17 – 5th April 18. In the tax year 2018 – 19 this will increase to £11,850.

For example, if you purchased two properties valued at £75,000 with 10% net income:

£15,000 income

£12,500 allowance

£2,500 taxable at 20%

= £500 tax

Tax Implications for Overseas Investors

You will get a tax-free personal allowance if you are a citizen of a European Economic Area country, or you have worked for the British Government at any time during that tax year.

You may also get a tax-free personal allowance if you reside in a country that is included in the double-taxation agreement. More details on countries that are in the double-taxation agreement can be found here.

Bank lending and mortgage availability

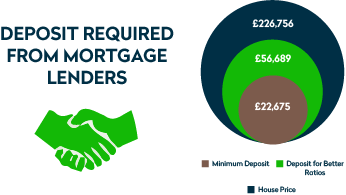

Different types of property may qualify for different types of mortgages (or not at all). Also, mortgage options for overseas investors may be limited. Read below for more details on what mortgages may, or may not, be available when buying UK residential property.

Typically, commercial properties such as care homes and student property do not qualify for mortgages, because residential lenders do not provide loans for commercial property, and commercial lenders would generally only consider larger purchases of £500,000 or more.

Mortgages are not available on residential properties under £150,000 to overseas landlords. There is no finance on commercial properties such as student properties and care home investments.

Choosing an area with sustainable demand

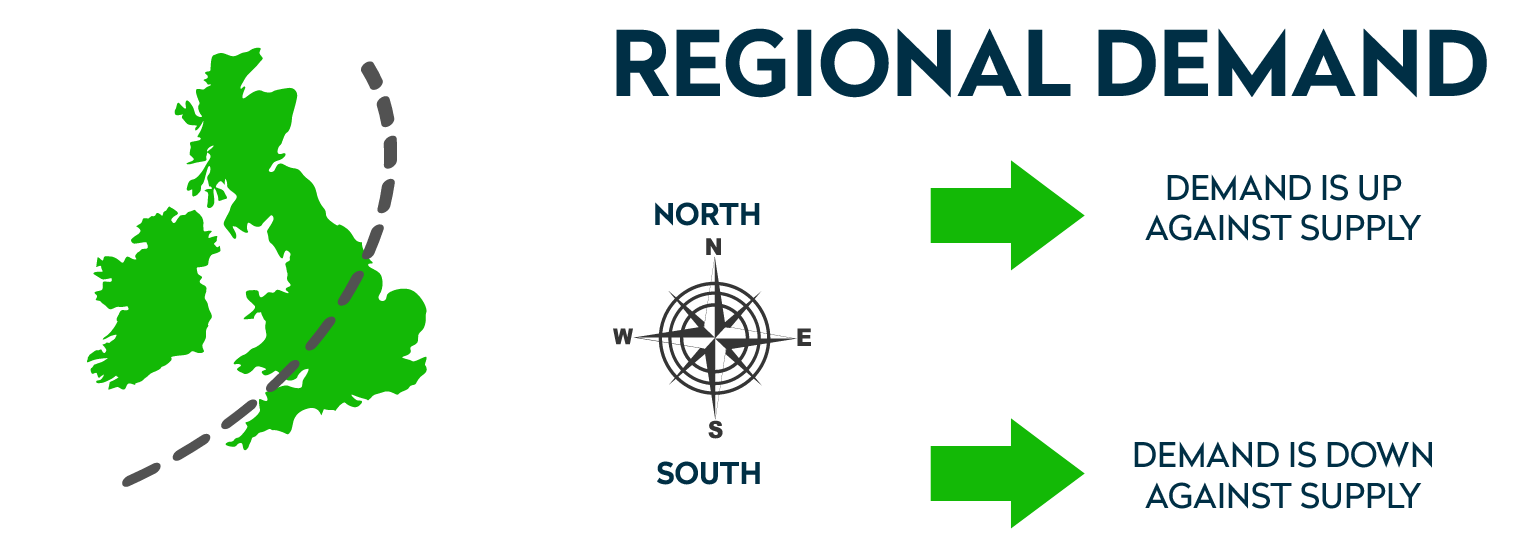

There is little point investing in student property in a remote village on the south coast and investing in retirement homes in a busy metropolis may not be the best idea. When choosing an investment type, it is wise to study the demographics of the area and weigh up the existing supply vs demand.

When buying UK residential property it is advisable to consult companies such as One Touch Property, who have experience sourcing UK property investments and can discuss investment options with you to help you find the best investment in an area with good fundamentals.

Purchase process for property investments outlined

- Work out your budget

- Research areas

- Choose your preferred unit

- Pay a reservation fee of between £2500 - £5000

- Begin the conveyancing process

- Exchange contracts (minus the reservation fee).

- Completion

- Receive your income

Work out your budget

Work out how much you can afford and account for stamp duty, legal and conveyancing fees. Remember that if you require a mortgage, you will generally need a deposit of at least 10% of the property’s value.

Research areas

You will need to research areas to ensure that property prices there are affordable. You will also want to work out whether on top of fees and other repayments, the rental income will be substantial enough for you to make a profit.

It may be impractical for overseas buyers to conduct significant research, especially if they are not familiar with various areas in the UK. Therefore, overseas buyers may want to seek advice from property investment consultants at One Touch Property.

Choose your preferred unit

This is important if you are going to occupy the property yourself, as you may have a preference in terms of lighting or the direction the unit faces. For overseas buyers who are not planning to live there, it is not important to focus too much on one apartment.

Pay a reservation fee of between £2500 - £5000

Once you have decided on a unit, you will be required to complete a reservation form and send it off along with proof of ID and address. You will then need to transfer a reservation deposit which will typically be between £2500 - £5000.

Begin the conveyancing process

Once you have made an offer and it has been accepted, you will need to instruct a solicitor who will begin the process of transferring the property into your name.

If you have taken out a mortgage on the property, the lender will typically want a valuation survey completed to ensure that it is worth what they are willing to loan you. If the valuation discovers any problems, you may want to reduce your offer to account for the repair work that has to be undertaken.

Exchange contracts (minus the reservation fee).

Your solicitor should let you know once they have completed all the relevant searches and investigations. Once your mortgage lender has provided you with a firm offer, you are ready to exchange contracts. At this point, you are committed to buying the property.

Stage payment of 25%

Completion

Completion involves handing over the funds to buy the property. Usually this is managed by the solicitor on your behalf. You will generally be charged a small telegraphic fee to transfer the funds by your mortgage lender and will have around 30 days to pay any Stamp Duty owed.

Receive your income

When buying UK residential property and you rent it out your rental income will generally be paid quarterly, but overseas investors will be required to complete a Nrl1 tax form. Property investment opportunities offered by One Touch are hands-off, meaning that investors will not have to worry about carrying out maintenance work or advertising for potential tenants.

We understand that investing in the UK may be especially daunting for those who live overseas. Everyone who invests a significant amount of money in property will be thorough in their research, but when one is investing in a place that is perhaps thousands of miles away, and they are unfamiliar with the process and terminology; it can be especially stressful. If you are considering UK property investments, contact us today for UK property investment advice and we can share our expert knowledge with you on buying property in the UK as a non-resident.

If you are an overseas buyer, you may be considering buying UK residential property as a non-resident whilst the value of the pound is down. Discover the best places to buy property in 2021 today.

Start your property journey...

Recommended Properties

Related Articles

Are you curious?

Speak with an experienced consultant who will help identify suitable properties that will capture the exciting fundamental mentioned here.

WANT TO LEARN MORE ABOUT PROPERTY INVESTMENT?

SIGN UP TO OUR NEWSLETTER NOW!