Should landlords invest in social housing

The investment case for social housing

What is social housing?

- The aim of social housing

- What is the trend for social housing in the UK?

- Can landlords invest in social housing?

Social housing is accommodation provided by housing associations or local councils. They run on a not-for-profit basis, and act as the landlord to social housing tenants. Social housing is a term often used interchangeably with council housing, although there are slight differences in the rights you get as a tenant and the contract that you sign. Also, council housing is owned by the local council, and they set the rent. Social housing is owned and maintained by local housing associations.

Now more than ever there is a need for affordable housing and the gap in the market is an opportunity for investors. As the rent the landlord receives from the tenant is often government-funded, investors can receive long-term income from tenants whilst also providing a valuable service to society. Here is what landlords need to know if they are considering a social housing investment.

The aim of social housing

The aim of social housing is to provide a less expensive and more secure alternative to privately renting. Social tenants often have better rights, and this allows them to lay down long-term roots in the area. Social housing is also quality controlled, and they are more likely to be better insulated, more energy efficient and have working smoke alarms compared to other types of housing.

Who qualifies for social housing?

Councils are obliged to accept applications from those who are:

- A British citizen who is living and settled in the UK aged 18 or over (though some councils accept applications if you have turned 16)

- A citizen of another country with the right to stay in the UK with no restrictions on how long they can stay

There is a limited supply of social housing and often a long waiting list, therefore most councils operate a points-based system to prioritise those most in need. Highly influential factors that would make someone a priority include:

- Someone who is currently homeless

- Someone living in cramped conditions

- Someone whose current living conditions have caused medical issues

- Other factors that would influence a decision include:

- Someone connected with the area or long-term resident in the area

- Someone whose work is in the local area

- Caring for someone in the local area

- Someone whose income is below a certain level

How is social housing funded?

Housing associations are funded by the rent and service charges collected through tenants. Sometimes, tenants would be in receipt of Universal Credit from the government to help them pay for the rent. They would be eligible for Universal Credit if:

- The tenant is on a low income or out of work

- The tenant is 18 or over (there are some exceptions if they are 16 to 17)

- The tenant is under State Pension age (or their partner is)

- The tenant and their partner have £16,000 or less in savings between them

- The tenant lives in the UK

More people are claiming for Universal Credit. There are several reasons for this. Firstly, there are more people on zero-hours contracts. They are commonplace in the hospitality sector as the requirement for labour depends on the season and so flexibility is needed. Although some find these types of contracts convenient as they can fit work around other commitments, wages fluctuate month-to-month and sometimes they need extra income. Covid-19 has also had a huge impact on the unemployment rate in the UK, which now stands at 5.1%.

Between the 16th – 31st March 2020 at the beginning of the pandemic, a total of 950,000 people started claims for Universal Credit. This was ten times the usual number of claimants and shows the significant impact the pandemic has had on the economy and jobs market.

What is the trend for social housing in the UK?

Over the last couple of years, the government expanded on plans to firstly help prevent homelessness and secondly to help those who have been made homeless. The government has also set up the Affordable Homes Programme that aims to build up to 180,000 affordable homes, half of which will be for Affordable and Social Rent, and 10% for specialist or supported housing. This programme will begin this year and end in 2026.

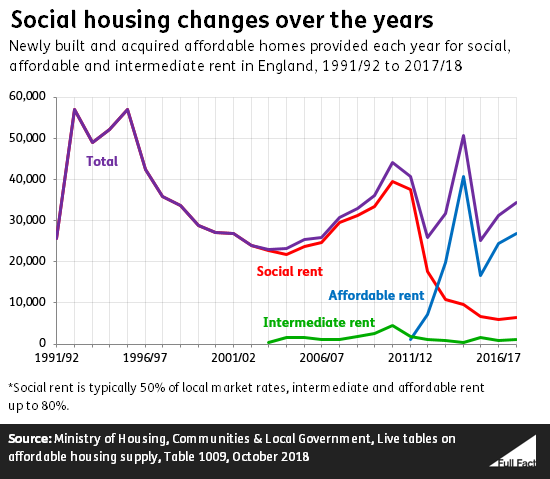

The amount of social housing has been steadily in decline for decades due to schemes such as Right to Buy and the inadequate replacement of council houses that were bought by tenants. But there has been a govenrment effort to boost the amount of social and council housing across England.

Government plans to eliminate homelessness and rough sleeping

In 2017, the government announced the Homelessness Reduction Act. This made local authorities responsible for intervening at earlier stages to prevent homelessness in their area. It also meant that housing authorities were required to provide services for all, not just those with a priority need. Public authorities were also required to refer people they suspected were homeless or at risk of becoming homeless to housing authorities. £1.2 billon was pledged to fund the Homelessness Reduction Act.

In 2019, the government announced a further initiative to eliminate homelessness. They put the issue at the heart of the party’s agenda and pledged £260 million to local authorities to support those who are homeless or are at risk of being made homeless.

Government funding schemes for affordable housing

One way in which the government is trying to address the homelessness situation is by providing more affordable housing. Affordable housing encompasses social rented properties, affordable rented and intermediate housing. These properties will be available to those whose needs are not currently being met by the market. Social rent is around 50% of market price, and affordable rent is around 80% of market price.

In England, Homes England is responsible for the delivery of social housing. From April 2021 they will make £7.39 billion available to deliver up to 130,000 affordable homes outside of London by March 2026. Developers and housing authorities can apply for funding to cover the capital cost of building socially rented properties, affordably rented properties and homes sold under the Shared Ownership scheme. In London, the Mayor of London Sadiq Khan has pledged £4 billion to build new well-designed and safe social housing.

When developers start building new properties, local authorities will agree a certain percentage of homes that will be classified as affordable housing, which is usually between 25 – 40%. Alternatively, the developer can provide an equivalent financial contribution. Units that are socially rented would be sold on to a housing association. We work with reputable housing associations that buy these properties and rent them to social housing tenants, learn more about our property sourcing principles we consider when analysing new investment opportunities.

Can landlords invest in social housing?

Although the government has pledged billions to deliver affordable housing, it is not enough to fund the amount of affordable housing needed. Providers of social housing have become increasingly reliant on private investors to bridge the gap.

Investors would purchase housing and lease it back to the provider. Social housing is less expensive than other property types and we have sold houses priced from £33,000 that have been rented socially.

The directives the government has put in place to supply more socially rented housing, coupled with the government paying the rents through Universal Credit means that there is opportunity for landlords to invest and receive a steady income from the tenants.

As economic uncertainty looms, more people are re-evaluating their living situations. According to a YouGov poll, a fifth of renters aged between 18-24 say they plan to move home as a direct result of the pandemic. The same poll reports that sixteen per cent of 18-to-34-year-old renters are ending their leases and moving back home with their parents.

The pool of potential tenants has shrunk in the traditional buy to let sector, yet demand has remained steady for social hosuing. This is partly due to unaffordable house prices but has been compounded by rising unemployment. As more people struggle to pay private rents, we will become more reliant on the social housing sector.

The demand for social housing allows for high, long-term occupancy levels. As social housing is a scarce commodity, once tenants finally get to rent one, they are not likely to move on quickly. According to The English Housing Survey, the average length of time a private sector tenant had lived in their current home was 4.1 years in 2017/18, yet according to government figures, two-thirds of new social tenancies issued in 2018/19 were lifetime tenancies. Long term tenants are more likely to take care of their home and report any malfunctions as they have a vested interest in the condition of the property.

These factors make social housing a sector that landlords should consider investing in if they are looking for affordable property that can house long-term tenants, whose rent is paid by the government. We work with reputable providers that have good balance sheets and operate in areas where there is the greatest need. Investors would purchase a property to be used as social housing, and then lease it back to the provider.

Social housing investment opportunities

One example is this apartment on Clifton Street in Blackpool. Located on Blackpool’s high street, this two-bedroom apartment can be purchased for £48,500 cash-only. It has recently been converted from an office to residential apartment and is tenanted with yields of up to 10% achievable.

There is also an opportunity to invest in freehold individual and HMO properties in the north of England, that are rented out on a social housing basis. The property is then leased back to a blue-chip company registered in England which manages the housing of vulnerable tenants. The investor would deal through the company and essentially, the company would become the tenant.

Start your property journey...

If these affordable, high yielding property investment opportunities sound of interest, please contact us today to find out more.

Recommended Properties

Related Articles

Are you curious?

Speak with an experienced consultant who will help identify suitable properties that will capture the exciting fundamental mentioned here.

WANT TO LEARN MORE ABOUT PROPERTY INVESTMENT?

SIGN UP TO OUR NEWSLETTER NOW!