Best places to invest in student property

Top places to invest in student property

Where should investors consider buying student buy to let property?

- Is the UK student property market still attractive to investors?

- Alternative options for investors within the student property market

- Are student property investments sustainable?

- Where are the best places to invest in student property in the UK?

There are many events that have occurred in recent years that could have affected the student property market, from Covid to Brexit. However, if you choose the area for your investment wisely, you can still achieve good rental yields.

When it was announced that the UK was leaving the European Union, doubt was cast over whether the United Kingdom would still be an attractive place to study. There were concerns over whether EU students would have to pay higher fees, and what their status would be after they had finished their studies, and arguably this has deterred some from choosing to attend a university in the UK.

That being said, the United Kingdom is still home to some of the best universities in the world, and the dip in the value of the pound has made it more attractive for those from outside the EU to study. Considering the profitability depends upon such a delicate balance of numbers, is it still worth considering student property investment opportunities? If so, where are the best places to invest in student property?

Start your property journey...

Is the UK student property market still attractive to investors?

The outlook for UK student property market remains positive and there still appears to be strong demand from institutional buyers for UK student property. Cushman and Wakefield report that student property will remain a robust and profitable asset, due to strong demand. The UK maintains a healthy amount of student applications, with overseas applications up from 2019 figures. In partnership with Rasameel Investment Company, Cushman and Wakefield have just acquired two developments in Edinburgh and Leicester for a combined £22.2m. This indicates their continued confidence in the market.

Alternative options for investors within the student property market

Investors do not have to invest in shares or a student fund. Other options include studios in purpose build student property developments. On average, the studios typically cost £80,000, with the more affordable student en-suite rooms (pods) priced just below £60,000. The typical net income ranges between seven to eight percent (7%-8%) after full management and other associated costs have been deducted. The benefit of investing in studios and pods is that an experienced management company will generally handle the day-to-day maintenance, and issues such as finding new tenants and marketing the studios. This lifts an enormous weight off the investor’s shoulders, and means it is perfect for the individual who cannot dedicate a lot of time to the investment, or for those who are living overseas and cannot be physically present to undertake daily maintenance tasks.

Are student property investments sustainable?

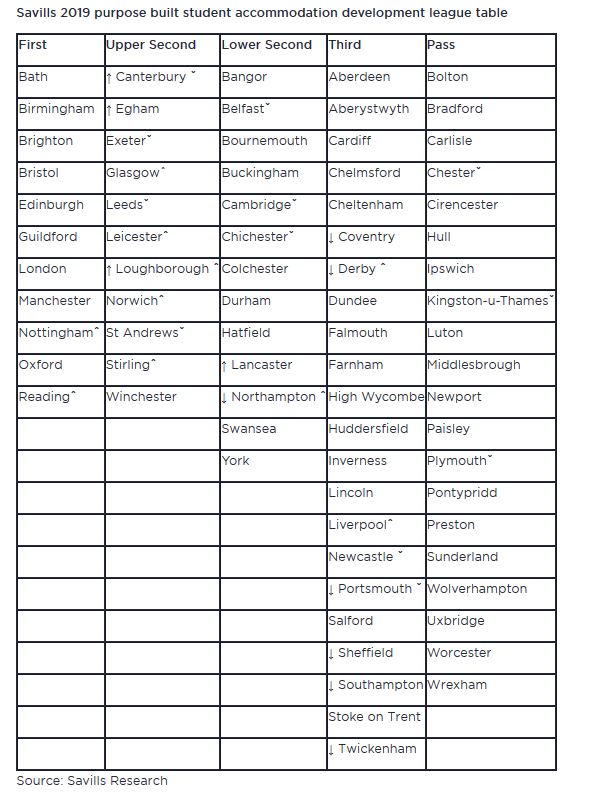

Those concerned about the sustainability of the UK student property investment sector can draw upon the analysis provided by global real estate consultancies such as the Savills in depth report on the student market.

The report measures a number of factors including current availability of purpose-built student properties as well as the pipeline of future developments balanced against the student demand and university rankings.

So where are the best places to invest in student property in the UK?

Start your property journey...

Birmingham

Not only is Birmingham a good choice for buy to let investments, it is also promising for those looking to invest in student property. The city itself is hoem to five universities, so there is a large number of students. Property itself is also cheaper compared to other cities, even purpose-built student accommodation. In the Savills Student Property Development League Table, it was ranked in the first tier. Cities are ranked due to predicted occupancy rate and rental yield achieved after supply and demand fundamentals are measured.

Nottingham

Nottingham was also ranked in the top tier in the Savills Student Property Development League Table.

Home to over 70,000 students, Nottingham has one of the largest student populations of any city in the United Kingdom. It is ideally located in the middle of England, and its strong transport links makes it easily accessible from most other parts of the United Kingdom.

It boasts a £12bn economy, making it the economic capital of the East Midlands and £1bn has just been invested in transport links and infrastructure.

Article 4 direction has been adopted in Nottingham for the past six years. Article 4 direction prevents family homes being converted to houses of multiple occupation. Thereby restricting the supply of student housing. Where demand has continued to grow, prices have continued on an upward trajectory much to the delight of Nottingham landlords.

The only way to accommodate more students in Nottingham is through the development of purpose-built student accommodation units. As the council has restricted the supply of alternatives, good occupancy levels can be achieved.

Leeds

What makes Leeds and attractive city for student property investment?

Leeds is ranked in the upper second tier for student property demand. The vibrant city attracts a cosmopolitan crowd and the renowned University of Leeds attracts students from across the UK and overseas.

Leeds has the ideal environment for a good student property investment. Historically, development levels have been low, so there is not much competition and high demand. Due to the fact that students generally come from far afield to study in Leeds, many need accommodation as opposed to commuting in from home. Thirdly, they are more likely to choose purpose-built student accommodation over university owned halls of residence.

Leeds has one of the most diverse economy of the all the UK’s main employment centres. In 2016, Leeds saw the fastest rate of private sector jobs growth of any UK city and has the highest ratio of public to private sector jobs of all the UK’s Core Cities.

Marks and Spencer’s was founded in Leeds. Back in 1884, Michael Marks opened up his penny bazaar stall in Leeds Market before enlisting the help of Tom Spencer a decade later. Soon after, they moved to a permanent spot just around the corner and the rest, as they say, is history.

Contact us today to find out more information regarding the best places to invest in student property.

Download our free student guide to learn more!

Start your property journey...

Recommended Properties

Related Articles

Are you curious?

Speak with an experienced consultant who will help identify suitable properties that will capture the exciting fundamental mentioned here.

WANT TO LEARN MORE ABOUT PROPERTY INVESTMENT?

SIGN UP TO OUR NEWSLETTER NOW!