South African Property Terms and UK Alternative

House buying terminology UK and South African equivalent

South African Property Terminology and UK Equivalent – Made Simple

South Africans thinking of investing in UK property may be slightly reticent when they first start looking into the industry and discover new terms they may not have come across before. Below we identify the most commonly used terms in property that are used in South Africa, and the British equivalent

Costs of buying property in South Africa

When you buy property in South Africa, you’ll typically need to pay transfer duty plus a registration fee and conveyancing fee.

UK solicitors

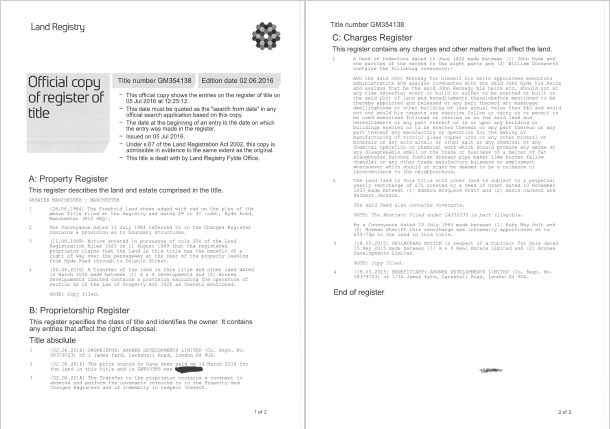

SA Deeds Registries where documents are available for public viewing. UK has a database holding digital records of all UK property titles deed to search online and that can be downloaded for only £3. This is one of the most advanced and transparent deeds registry systems in the world.

SA Transfer Duty = Stamp Duty

SA transfer duty is not applicable in all property sales, as it depends on the property price:

Up to ZAR 750,000: 0 percent

ZAR 750,000–1,250,000: 3 percent

ZAR 1,250,000–1,750,000: 5 percent

ZAR 1,750,000–2,250,000: 8 percent

ZAR 2,250,000+: 11 percent

Transfer duty is often paid through your conveyancer at the point of purchase, otherwise it must be paid within six months of agreeing to buy your home (not the date of the completed sale). If you don’t pay on time, you’ll be subject to interest at 10 percent per annum each month.

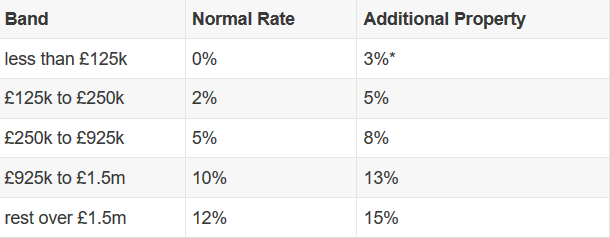

UK Stamp Duty

Property for sale South Africa

Registration fees are also due to finalise the property transfer:

Up to ZAR 150,000: ZAR 70

ZAR 150,000–300,000: ZAR 350

ZAR 300,000–500,000: ZAR 450

ZAR 500,000–1,000,000: ZAR 550

ZAR1,000,000 – 2,000,000: ZAR 650

ZAR2,000,000 – 5,000,000: ZAR 1,050

ZAR 5,000,000+: ZAR 1,250

UK title register fees £50 – £150

SA taking transfer = UK exchange of contracts

The difference in South Africa is when you make an offer and it is accepted it is a binding offer. In UK, it is only at the point of the formal exchange of contracts that the sale become a binding legal agreement. This is important for the off-plan residential property investments that we source at One Touch. The developers of buy to let property that we work with normally require a 30% deposit and the balance at completion. All the details about the specification are documented in the purchase agreement and the developer has an obligation to meet the contracted standard at completion thereby giving overseas investors peace of mind.

Taking occupation = completion in the UK

This is concerning properties which are off plan. Completion is when the building is finished to the specification of contract at exchange. Final payment needed either by cash or mortgage.

Sectional Title – Leasehold

In South Africa, a sectional title means that an individual owns a unit within a communal building and a portion of the communal areas. In the UK, the equivalent is a leasehold, where an individual owns a flat or apartment within a complex. In the UK the freeholder (who owns the ground the building is built upon) retains ownership of the communal areas.

Levy = service change

In South Africa the governing body looks after the procurement and maintenance of the communal areas of the property complex. In the UK the freeholder installs their own management company and the leaseholder is bound to pay for these via a service charge. In the UK, leaseholders are protected by the Leasehold Tribunal, which sets the maximum leaseholders can be charged for services. In South Africa, people are granted no such protection.

If you are from South Africa and you are interested in UK property investments, why not next read our guide for buying UK property as an overseas investor?.

Start your property journey...

Recommended Properties

Related Articles

Are you curious?

Speak with an experienced consultant who will help identify suitable properties that will capture the exciting fundamental mentioned here.

WANT TO LEARN MORE ABOUT PROPERTY INVESTMENT?

SIGN UP TO OUR NEWSLETTER NOW!